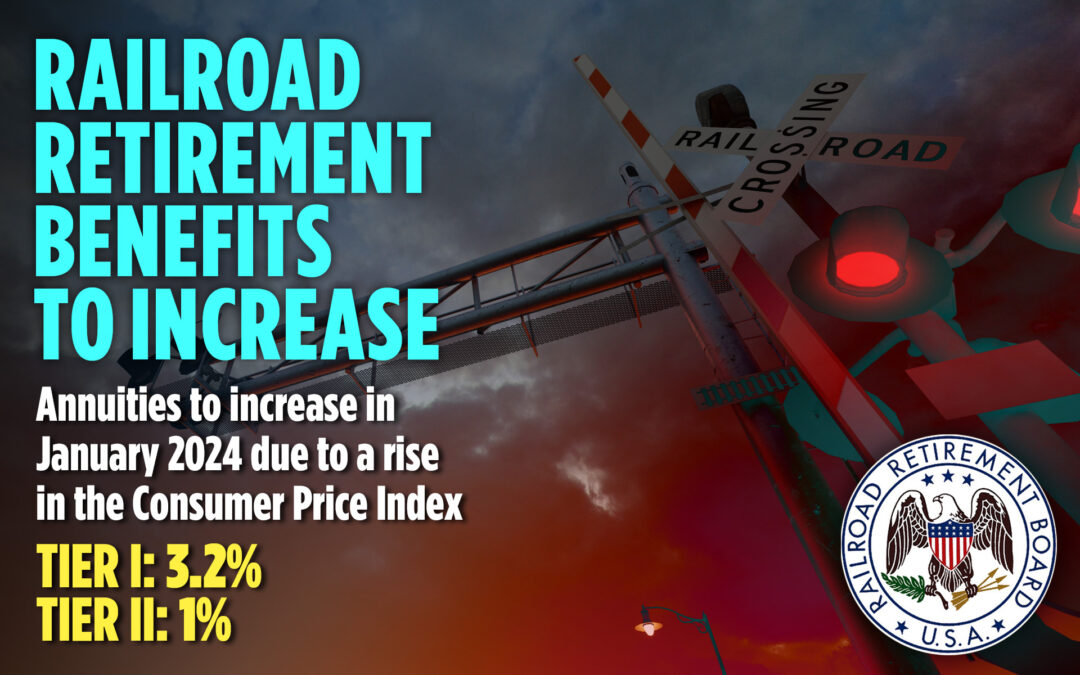

Most railroad retirement annuities, like social security benefits, will increase in January 2024. Cost-of-living increases are calculated in both the tier I and tier II portions of a railroad retirement annuity. The tier I portion, like social security benefits, will increase by 3.2 percent, which is the percentage of the Consumer Price Index (CPI) rise. The tier II portion will go up by 1.0 percent, which is 32.5 percent of the CPI increase. This follows an 8.7 percent increase in the tier I portion and a 2.8 percent increase in the tier II portion of railroad retirement annuities in January 2023. Additionally, railroad retirement annuitants subject to earnings restrictions can earn more in 2024 without having their benefits reduced due to increased limits indexed to average national wage increases. For those under full retirement age throughout 2024, the exempt earnings amount rises to $22,320 from $21,240 in 2023. For beneficiaries attaining full retirement age in 2024, the exempt earnings amount, for the months before the month full retirement age is attained, increases to $59,520 in 2024 from $56,520 in 2023. Learn more at the Railroad Retirement Board website.

BLET NEWS

- July 26, 2024

- July 26, 2024

- July 25, 2024

- July 24, 2024

- July 24, 2024

DAILY HEADLINES

- July 26, 2024

- July 26, 2024

- July 25, 2024

- July 25, 2024

- July 25, 2024